How media planning differs across regions and how Advvy is solving the challenge of global media plan reporting

Media planning is dictated by media consumption habits

Sources:

USA (2022) : https://www.marketingcharts.com/advertising-trends-114887

China (2021) - https://www.fortuneindia.com/venture/digital-ad-spend-grew-26-in-2019-dan-report/104027

India (2019) - https://hpachina.org/2021/04/20/china-digital-ad-spending-2021-tech-giants-keep-on-cashing-in/

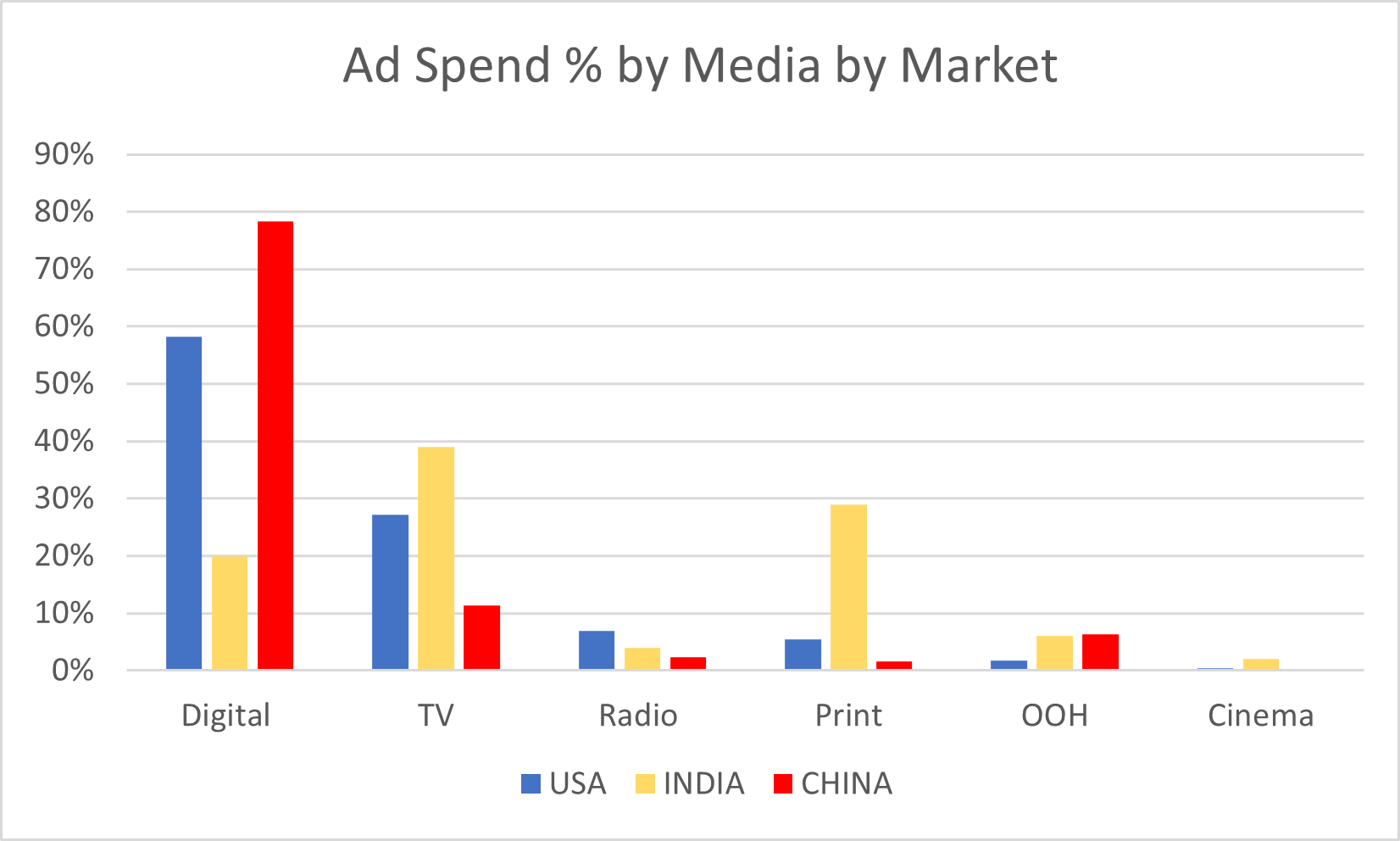

Comparing USA, India and China

These markets were chosen to compare as they have very different consumer habits. The media advertising spend by media type in each market was compared. Note: Cinema is included in OOH in China.

Insights from this data

USA : Ad spend is heavily skewed digital, with still a significant TV spend. And because of the size of the market, radio, print and OOH all play their role on delivering an effective media plan.

India: With over 50% of the population still without internet access, the traditional mediums of TV and print remain dominant.

China: Most of the ad spend is digital. Mobile advertising is a large percentage with apps like WeChat dominating the lives of Chinese people

What does this mean for media planning?

For a global brand that is advertising in each of these markets, media plans are going to reflect the media consumption behaviours of the consumers. After all, the ad spend data comes directly from media plans that are bought for brands in each market.

Due to the ever-changing complexity of the media mix in each market, and due to the different systems used to buy media and invoice clients, Excel remains the go-to media planning tool to plan first.

It’s extremely inefficient forcing media planners to use a centralised media planning software that isn’t fit for purpose in each market. Often these tools aren’t flexible to handle the complex rate calculations and deal structures than many media agencies have with their local suppliers. Further making it harder for local media planners, other media planning tools require a universal naming convention of media reference data that is dictated by the global brand and that may not be logical to other markets.

As a result, media planners servicing global clients in their local market are most often rekeying media plans from Excel into a global media planning tool.

Advvy has solved these big challenges

For global brands that are looking for a global media planning tool to consolidate their media plans, it makes sense to work with the way the local markets are working.

By allowing media planners in each market to plan media their way, Advvy has made the process of consolidating media plan data for global brands not only easier and more user friendly, but also faster and more accurate.

The Advvy Media Planning Excel Add-in syncs data from any Excel media plan template to Advvy's media planning software. This saves media planners hours each week from rekeying data into an inflexible global media planning tool. And it delivers data to the brand immediately.

The Advvy Agency media planning software harmonises data automatically with alias naming conventions for any reference data. This ensures data is presented how it should be without planners needing to learn a non-native media nomenclature.

The Advvy Brand portal then presents a consolidated view of global media plans and detailed media expenditure reports tailored to a global brand.

With Advvy’s post campaign data management approach it’s possible to have actuals reported on against media planned.